The largest companies in the world in terms of market capitalisation are now digital platforms. In the US, Google, Apple, Facebook, Amazon and Microsoft have become the giants we know in just a few years. In China, it’s Alibaba, Tencent and Baidu. Europe is following in their wake with success stories such as Doctolib, Meero or BlaBlaCar in France; Deliveroo, Transferwise or Zoopla in the UK; and Auto 1 Group in Germany. Are these digital platforms a threat or an opportunity for traditional companies? Is the “platform model” suited to specific sectors or types of companies? What technologies and organisational models are behind this success? Benoit Reillier was recently interviewed by Malcolm Boyd, Partner from design thinking consultancy Suricats. Benoit tells us how we can all draw positive inspiration from these examples of digital platforms.

Malcolm Boyd

Hello Benoit. To begin with, can you explain what a platform is?

Benoit (Launchworks & Co)

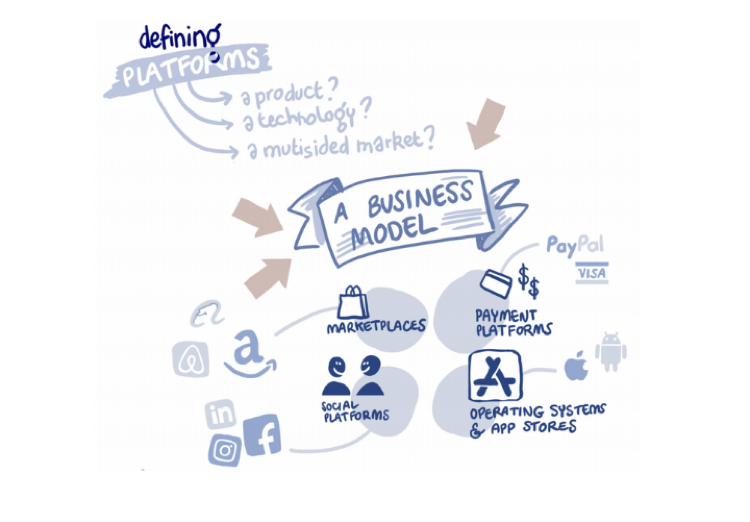

A platform is first of all a business model. It creates value by attracting and connecting a large number of participants to enable them to make transactions. It’s very different from the linear way traditional firms operate, where inbound raw materials are received and transformed into products that are then distributed and sold. By contrast the platform model is not linear and very open. It powers companies such as Airbnb, BlaBlaCar and eBay, the latter being one of the very first digital platforms.

Malcolm

So, a platform is a model for connecting people? People who have a product or service to offer, and others who are looking for it?

Benoit

Exactly! There is the producer side and the user side. Both sides are participants and therefore customers of the platform. Unlike linear models, producers are not traditional suppliers because they participate directly in the co-creation of value. In fact, we have two sides looking to meet. The platform has the role of structuring this ecosystem. It attracts a critical mass of participants, puts them in touch and allows them to transact. This can be for the purchase of a service or a product. It can also be the exchange of content, as we see a lot on social networks. Or an exchange of money/financial assets with payment/financing platforms. It could even be digital products, like it’s on the Apple App Store. Platforms can take many different forms, but the basic principles are the same: connecting people to enable them to transact.

Malcom

At the beginning when we think of a platform, we think of course of the big players that you mentioned, eBay or even Amazon. But we realise that this model is invading all sectors of activity, including transport like a BlaBlaCar in France. Do you have examples in other sectors?

Benoit

All sectors are impacted by this dynamic. There are areas that we know well and that were immediately disrupted like taxis. You mention BlaBlaCar, but there are many platforms active in the mobility sector: Uber and Lyft of course, who collided head-on with traditional players in a closed market historically protected by a ‘numerus clausus’. Without competition, this taxi market was neither necessarily very innovative nor very efficient. This allowed new disruptive players to innovate.

Malcom

What are the other sectors mainly affected?

Benoit

Education, health, finance, retail, and markets where there have historically been many intermediaries. By creating trust, platforms were able to successfully scale and reach critical mass. Platforms also appeared in unexpected markets. For example, the automotive market. Even though car manufacturing remains based on traditional value chain models – raw materials are needed to make and sell cars – all car manufacturers have realised that their outlets are going to be increasingly linked to “Fleet sharing” and that they were going to have to adapt. Almost all car manufacturers have therefore taken a stand by investing in platforms.

Malcom

It’s interesting because usually when we talk about platforms, we tend to think of companies with a strong technological background. Here, you cite the automobile. Does this mean that large traditional companies can also find their own path, their own way of using the model?

Benoit

Yes, it is entirely possible for traditional companies to add complementary platforms to their existing activities. This is what we call developing hybrid models. A good example is furniture manufacturer IKEA. They acquired TaskRabbit, a gig economy platform that now allows them to offer furniture assembly at home by ‘taskers’. It’s very important to understand this complementarity, because on closer inspection, many companies draw their strength from mixing business models.

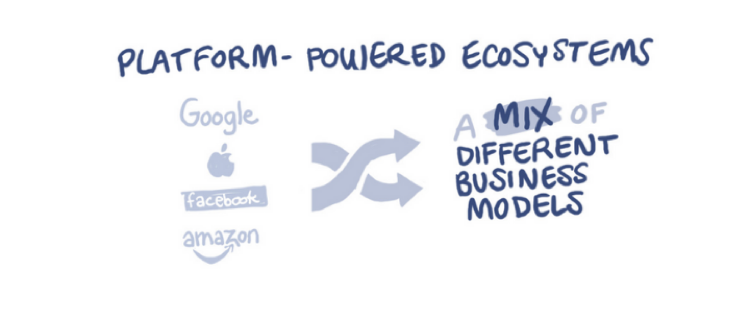

Even GAFAMs (Google, Amazon, Facebook, Apple, Microsoft – editor’s note) often incorporate part of traditional production in their activities, whether it is to make their smartphones, laptops or equipment such as connected speakers. But what explains their success is their ability to combine their linear value chain activities (i.e. building physical products) with digital platforms. For example, the Apple App Store is the heart of an ecosystem that is a real growth engine for the company. Apple therefore operates a platform-powered ecosystem. The app store platform strengthens the products with millions of apps available, which sell even better and therefore attract more developers, thus further strengthening this powerful ecosystem. For Amazon and Alexa / Echo, it’s the same logic. There is a content platform attached to the physical device. These business models mutually strengthen one another.

So, digital platforms can be a threat but also an opportunity for existing businesses !

Malcom

You mention the GAFAMs. In this very special period, when the Covid-19 crisis is testing all organisations and their employees, many digital platforms seem to continue to work… How do you explain this?

Benoit

Many platforms have indeed shown their resilience in these difficult times. First, because they are often native digital organisations, which gives them greater flexibility and adaptability for remote work for example. Second, because the platform business model, primarily based on connecting participants in an open ecosystem, is particularly resilient. Thus, online product platforms like eBay – with decentralised stocks held by third parties – continue to operate. They adapt to changing demand and supply patterns. Content platforms such as YouTube are also in high demand at the moment. And many service platforms (deliveries, troubleshooting, etc.) also continue to operate while many traditional stores and businesses have closed their doors. Many traditional BtoB (Business to Business) suppliers who saw orders disappear overnight (restaurant suppliers for example) are now using digital platforms as new distribution channels to pivot to BtoC (Business to Consumer).

Malcom

In a context of health crisis and global uncertainty, this resilience is a force that can really help communities …

Benoit

Absolutely. Platform resilience helps governments protect their population. There are many discussions taking place in several countries to make sure, for example, that Uber Eats, Deliveroo, Glovo and others can function and deliver meals where they are needed. Providers like Mirakl have helped the French government set up medical product platforms. Doctolib helps organise video consultations with healthcare professionals, thereby increasing the resilience of the entire country.

This organisational resilience of ‘platform companies’ is not total, and many platforms requiring physical contacts like BlaBlaCar have been impacted. On the other hand, the crisis revealed how agile these organisations are. In seven days the BlaBlaCar teams have developed and launched the BlaBlaHelp platform to allow neighbours to help each other with their shopping. But even when platforms with physical contacts are exposed, they often have a lighter cost structure than traditional companies. This is an advantage in this period of uncertainty.

Malcom

Let’s go back to this idea of a native digital organisation. What part does technology play in the development of platform companies?

Benoit

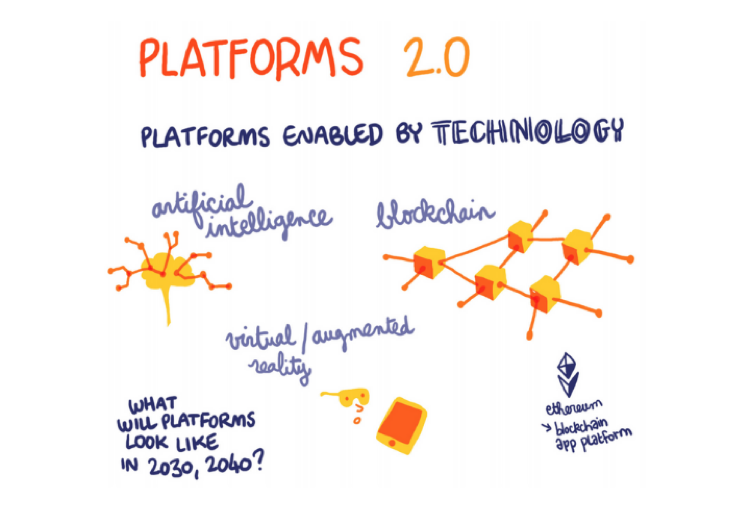

When there is a technological breakthrough, two things can happen. Some companies will take over the new technological cluster to be more efficient while keeping their business model. This was the case with the web in the early 1990s, or with blockchain and artificial intelligence today. The process of digital transformation is often initially focused on efficiency improvements. Becoming at producing cars, managing inventory, or even making sales projections using artificial intelligence algorithms. But there is also a second aspect. Being able to use technology to operate differently and adopt new innovative business models. Platforms were born out of this process: technology has enabled new modes of organisation to emerge. This is what is really different. These new modes of organisation form the basis of the platform model by unleashing the potential of the communities.

Malcom

Can you give us some particularly innovative examples that you have been able to spot recently?

Benoit

There are many. Almost half of the emerging and growing companies use this model, and among these, some are very innovative. I’m thinking for example of WeMaintain. The platform allows building managers to find a lift repairer quickly and at a reasonable price in the event of a breakdown. There are also digital platforms such as Brigad, which allows you to find qualified staff for restaurants. This type of platform allows both catering professionals to find employment, and restaurants to find staff at the right time, in case of occasional replacements for illness for example. Platforms like Brigad have been very impacted by the lockdown. But they showed their flexibility by nimbly pivoting towards home meal delivery, especially for caregivers.

The last example that comes to my mind that I find interesting is a project called IFynd. This startup intends to become a meta-platform for all lost and found items. Whatever the place or the country, they try to aggregate the different types of actors to give birth to a global platform. It’s brand new but the concept is interesting.

Malcom

In the three examples mentioned, the last one was more aimed at the general public, but the first two were more for professional use. For you, is the future of platforms more in BtoC or BtoB?

Benoit

In both! Although it is true that we do not always realise all B2B activities for a simple reason. BtoB is only visible to professionals of a given sector. Personally, I see a lot happening in BtoB as almost all sectors develop platforms. For example, there are many initiatives in the fields of agriculture, construction, transport, talent platforms, health, etc. Some “horizontal” BtoB platforms such as Amazon for Business or Alibaba have a wide range of products. Other more niche and specialised so-called “vertical” platforms are emerging in many industries for raw materials, specialised spare parts, commercial vehicles, etc.

Malcom

For a company that would like to address the subject, and wondering what could be a suitable platform model, what advice would you give them to get started and ask the right questions?

Benoit

I’ve learnt from experience that training decision-makers is the best way to start. Allow leaders to reflect and understand the business model. It is very important to have a clear and shared definition, an understanding of the underlying economic concepts such as critical mass, externalities, networks effects, etc. Get your management team to get their minds around what these new platform concepts. What they mean for their business is an essential starting point before being able to formulate a good strategy.

Malcom

And what would be the second step?

Benoit

Then, there is a stage of reflection, formulation of opportunities, identification of sector specific threats and opportunities. Sometimes the strategic response is not necessarily to add a platform or to become a platform. Rather it’s to identify ways in which your company could fit into this new ecosystem, using digital platforms as new distribution channels, as new sources of supply, as new ways of innovating… The answer may therefore be to partner with existing platforms. This type of thinking is part of a holistic platform strategy that almost all businesses will have to implement over the next few years. It is estimated that by 2025, almost 30% of all economic transactions will be intermediated by platforms. And since platforms seem to demonstrate enhanced organisational resilience the pace of change is likely to increase in times of crisis.

Malcom

You have followed many platforms over the past ten years. What are the pitfalls and mistakes to avoid?

Benoit

Often, established companies find it difficult during the investment phase. This is because their internal processes, which are optimised for their daily activities, do not work well to support the development of a platform model. The ways of thinking must therefore evolve from the ‘linear’ mode to that of ‘ecosystems’, staring with the finance team. We have also seen a lot of companies (startups or established) dive directly into software development before having thought about the platform’s business design. Unfortunately, this is often a cause of failure. Finally, when the needs are well understood, I recommend starting with an MVP and iterating. There are now many technological bricks that allow concepts to be tested before embarking on bespoke development.

Benoit Reillier is Launchworks & Co’s Co-Founder and Managing Director. For more in-depth information about digital platforms and their ecosystems, download the free cartoon Platform Strategy Illustrated.